Have you made any New Year’s resolutions? If so, was making a Will one of them? Only 4 in 10 UK adults have a Will – despite owning property. But why is it so important to have one?

A Will is a legal document that allows you to pass on your possessions to benefit others after your death, giving you control over what happens to your money, possessions and property after you die.

Many people often assume their possessions will simply pass automatically to their spouse or children and consequently don’t make any plans for the future after they are gone. Often people believe their assets are too small to require a formal arrangement or legal guidance.

If you die without having made a Will, the intestacy rules apply and may not reflect your wishes. Therefore, the only certain way to ensure that your wishes are put into effect is by making a Will.

Under the intestacy rules your spouse will receive a statutory legacy of up to £270,000 and your personal possessions. If your estate is worth more than £270,000 the balance is split with your children and so your whole estate will not necessarily all pass to your spouse.

Although it is increasingly common for partners to live together without marrying or entering into a Civil Partnership, at present the intestacy rules do not recognise these arrangements. Therefore, if you live with your partner and die without having made a Will, your partner will not automatically inherit any of your estate and would have to make a claim on your estate. This could mean them having to fight for their home at a time when they have just lost their life partner.

Family arrangements are also becoming more complex. If you have children from a previous relationship you can use a Will to protect assets for those children. For example, a Will can give a second spouse the right to occupy the family home, while protecting the capital for children of an earlier relationship.

A Will can also be used to protect assets against future care fees. If your estate passes absolutely to your spouse or partner on your death and your spouse or partner subsequently need care then your estate could be used to pay those fees. A trust can protect your capital for your children or other beneficiaries whilst allowing your spouse to remain in the family home and benefit from the income from any other capital.

What if you wish to leave gifts to charities or other organisations? Again, under the intestacy rules, this will not happen and so the only way to make sure your chosen beneficiaries do benefit is to make a Will.

Everyone’s situation is unique, and the best way to ensure your wishes are in place is to seek professional legal advice. A solicitor is highly regulated and insured. They will make sure that they understand your situation to ensure that you are given advice appropriate to that.

Schools Come Out In Force To Support "Wear What Makes You Happy" Fundraiser For Arlo Lambie

Schools Come Out In Force To Support "Wear What Makes You Happy" Fundraiser For Arlo Lambie

Entertainment Guide: February 2025

Entertainment Guide: February 2025

What to Watch in February 2025

What to Watch in February 2025

Island Update: January 2025

Island Update: January 2025

Ryde Rotary Centenary: 100 Years Strong

Ryde Rotary Centenary: 100 Years Strong

Home Style: Scandi Island Life

Home Style: Scandi Island Life

What to Watch in January 2025

What to Watch in January 2025

Entertainment Guide: January 2025

Entertainment Guide: January 2025

Memorial Held Following Death Of Kezi's Kindness Founder Nikki Flux-Edmonds

Memorial Held Following Death Of Kezi's Kindness Founder Nikki Flux-Edmonds

Mountbatten Inviting Islanders To Sign Up For 2026 Lapland Husky Trail

Mountbatten Inviting Islanders To Sign Up For 2026 Lapland Husky Trail

Home Style: Winter Wonderland

Home Style: Winter Wonderland

Help Available For Islanders To Cut Energy Bills

Help Available For Islanders To Cut Energy Bills

Island Update: December 2024

Island Update: December 2024

New Home For Citizens Advice Isle Of Wight

New Home For Citizens Advice Isle Of Wight

The Alternative Guide to Christmas Gifts

The Alternative Guide to Christmas Gifts

Island Family Launches Appeal For Teenage Son With Brain Tumour

Island Family Launches Appeal For Teenage Son With Brain Tumour

What to Watch in December 2024

What to Watch in December 2024

A Gardener’s Best Friend: The Story of Bob the Robin

A Gardener’s Best Friend: The Story of Bob the Robin

Memorial Quilt To Be Displayed On The Island

Memorial Quilt To Be Displayed On The Island

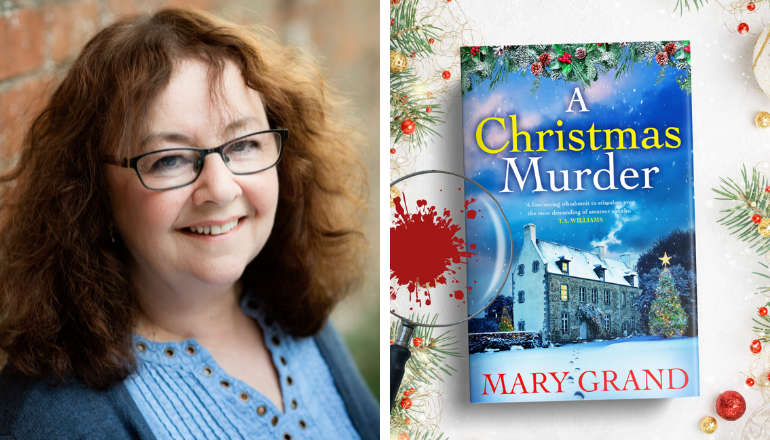

Island Author Celebrating Amazon Number One

Island Author Celebrating Amazon Number One